In the world of business, staying compliant with legal requirements is crucial for smooth operations and avoiding penalties. One such essential requirement in the UK is the confirmation statement. But what is confirmation statement, and why is it so important? Let’s dive into this topic to understand its significance and what happens if a confirmation statement is overdue.

What is a Confirmation Statement?

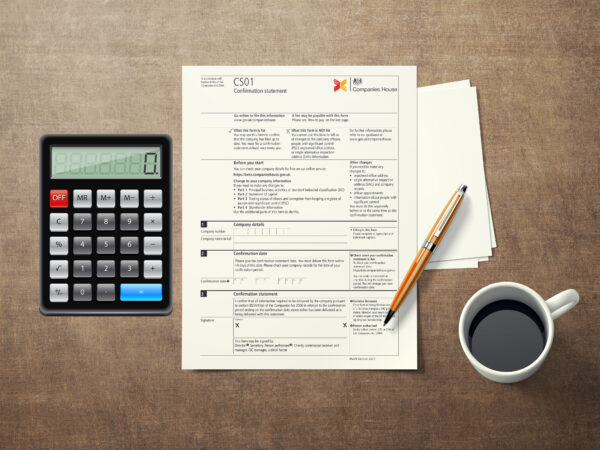

A confirmation statement, formerly known as the annual return, is a document that UK companies are required to submit to Companies House at least once every 12 months. This statement provides a snapshot of the company’s structure and essential details, ensuring that the public record remains accurate and up-to-date.

Key Details Included in a Confirmation Statement:

- Company Name and Registration Number: The official name and unique number assigned to your company.

- Registered Office Address: The primary address where your company is registered.

- Directors and Secretaries: Details of the individuals who manage the company.

- Shareholders and Share Capital: Information about the company’s shareholders and the distribution of shares.

- People with Significant Control (PSC): Identifying individuals who have significant control or influence over the company.

Filing a confirmation statement is relatively straightforward, but it’s vital to ensure that all information is accurate and submitted on time.

Why is it Important?

The confirmation statement serves several critical purposes:

- Legal Compliance: It is a statutory requirement under the Companies Act 2006. Non-compliance can lead to fines and legal consequences.

- Transparency: It provides transparency and maintains the public record, which is essential for stakeholders, investors, and other entities dealing with the company.

- Company Status: Filing this statement helps maintain the company’s active status and good standing with Companies House.

What Happens if a Confirmation Statement is Overdue?

Failing to file a confirmation statement overdue on time can lead to several issues:

Penalties and Fines:

Companies House can impose financial penalties for late submissions. The longer the delay, the higher the potential fines.

Striking Off:

Persistent failure to submit a confirmation statement may result in Companies House striking the company off the register. This means the company ceases to exist as a legal entity and cannot conduct business.

Legal Implications:

Directors of the company may face legal consequences for non-compliance, impacting their ability to serve as directors in the future.

How to Avoid Late Filing

To avoid the stress and potential penalties associated with an overdue confirmation statement, consider the following tips:

Set Reminders:

Mark your calendar with the due date for filing the confirmation statement. Companies House typically sends reminders, but it’s wise to have your own alerts in place.

Use Online Services:

Companies House provides online filing services, making it quick and convenient to submit your confirmation statement. This method also reduces the risk of postal delays.

Hire a Professional:

Consider hiring an accountant or a company secretary who can manage and file your confirmation statement on time. This ensures accuracy and punctuality.

Stay Organized:

Keep your company records up-to-date throughout the year. This makes it easier to compile and confirm the information when it’s time to file.

Filing a confirmation statement might seem straightforward, but there are common mistakes that companies often make. Avoiding these pitfalls can save you time, money, and hassle.

Incorrect Information:

One of the most common errors is submitting incorrect or outdated information. Ensure that all details, including addresses, director names, and shareholder information, are accurate.

Missing the Deadline:

Even a small delay can lead to penalties. Make sure you file on time by setting multiple reminders and using online filing services to expedite the process.

Not Updating People with Significant Control (PSC):

The PSC register must be accurate and up-to-date. Failing to update this information can result in fines and legal issues.

Overlooking Share Capital Details:

Ensure that the information regarding your company’s share capital is correct. Any changes in shareholding must be accurately reflected in the confirmation statement.

How to File a Confirmation Statement

Filing a confirmation statement can be done in a few simple steps:

- Log In: Access the Companies House Web Filing service with your company’s authentication code.

- Review Information: Carefully review the pre-populated information provided by Companies House.

- Update Details: Make any necessary updates to ensure all information is current and correct.

- Submit and Pay: Submit the confirmation statement and pay the filing fee (usually around £13 if done online).

- Receive Confirmation: Companies House will send a confirmation once your statement is processed.

FAQs About Confirmation Statements

Q: How often do I need to file a confirmation statement?

A: You must file a confirmation statement at least once every 12 months. The due date is typically the anniversary of the company’s incorporation or the date of the last filed statement.

Q: Can I file a confirmation statement early?

A: Yes, you can file a confirmation statement early if you prefer, especially if there have been significant changes that need to be recorded.

Q: What happens if there are no changes to report?

A: Even if there are no changes, you are still required to file a confirmation statement confirming that the existing information is up-to-date.

Q: Is there a penalty for filing a confirmation statement late?

A: Yes, there can be financial penalties and the risk of your company being struck off the register for persistent non-compliance.

The Role of a Company Secretary in Filing Confirmation Statements

A company secretary can play a vital role in ensuring timely and accurate filing of confirmation statements. Their responsibilities may include:

- Maintaining Records: Keeping detailed and organized records of all company activities and changes.

- Compliance Monitoring: Ensuring that the company adheres to all legal requirements and deadlines.

- Filing Assistance: Preparing and filing the confirmation statement on behalf of the company.

Having a dedicated professional to manage these tasks can provide peace of mind and allow business owners to focus on growth and operations.

Conclusion

In summary, understanding and properly managing your company’s confirmation statement is vital for maintaining legal compliance and avoiding unnecessary penalties. The confirmation statement is more than just a statutory requirement; it’s a key document that ensures transparency and accuracy in your company’s public records.

By staying organized, setting reminders, and utilizing online services, you can avoid the stress and complications associated with a confirmation statement overdue. Moreover, considering professional help can further ensure that your filings are accurate and timely, allowing you to focus on growing your business.